The urgent need for a sustainable Rare Earth Elements value chain in Europe

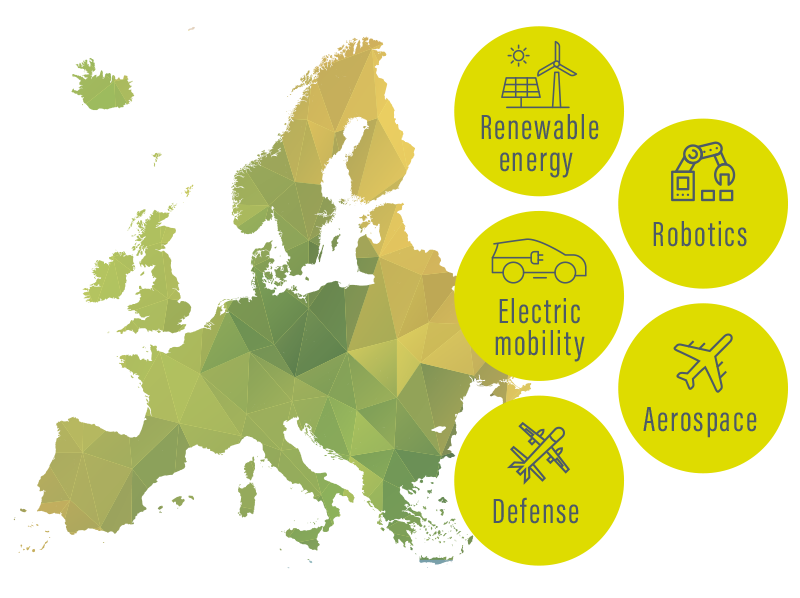

Enhancing Europe’s journey toward climate neutrality will fundamentally depend on our capacity to innovate clean energy and sustainable mobility solutions. However, this green transition will create a surge in the need for Critical Raw Materials (CRMs), such as Rare Earth Elements (REEs), specifically for the manufacturing of permanent magnets (PMs).

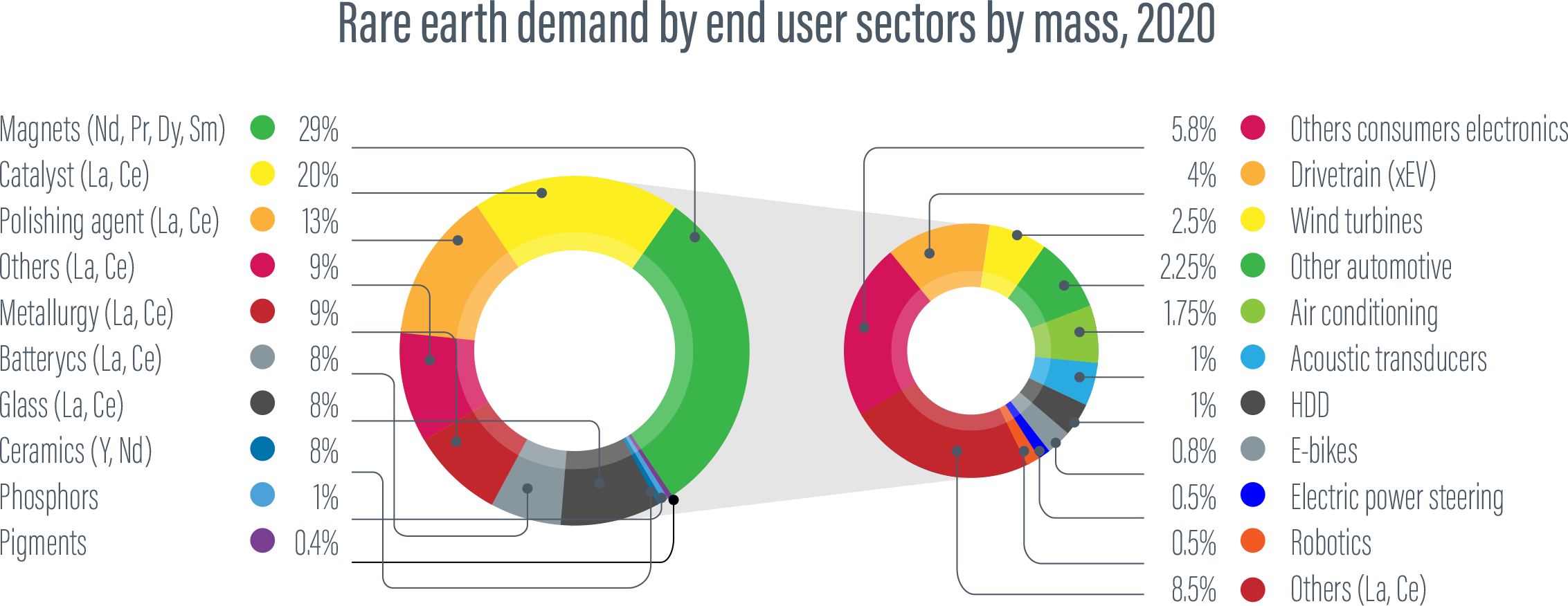

Permanent magnet industry is the largest REEs end-users, in particular:

NdFeB Permanent Magnet users in different application categories.

| APPLICATION CATEGORY | APPLICATIONS | |

|

Mobility applications | Electric Vehicles, Electric scooters/bicycles/motorbikes, hoverboards |

|

Renewable Energy | Wind turbines (onshore, offshore) |

|

Consumer electronics | Computers, smartphones, printers, digital cameras, hard disk drives. |

|

Acoustic devices | Headphones, microphones, loudspeakers |

|

Home appliances | Washing machines, Air conditions, refrigerators, Roombas |

|

Industrial applications | Industrial robots, pump, motors |

Reference: CEPS In-depth Analysis (2022) Developing a supply chain for recycled rare earth permanent magnets in the EU.

Current market scenario

In 2020, nearly 29 % of the worldwide demand for Rare Earth Elements was driven by the production of powerful Permanent Magnets, which is anticipated to climb to 36 % in 2030. These PMs are primarily composed of neodymium (Nd), praseodymium (Pr), and dysprosium (Dy), crucial components for high energy-efficient electric motors, which are vital devices in facilitating electric mobility, advancing renewable energy technologies, and other applications.

Notably, the price of neodymium soared to a 9-year peak in March 2021, experiencing a remarkable rise by 42 % since the beginning of the year. This fact triggered tension and uncertainty in the global hi-tech markets and the European Union’s green industries.

At present, the European Union (EU) relies mainly on imported PMs and REEs found in their composition. Given these circumstances, the European Union has labelled REEs as critical raw materials (CRMs) identifying them with the highest risk of supply. In March 2023, the European Commission published its proposal for a European Critical Raw Material Act (CRMA) to safeguard the green and digital transition by securing a stable and strategic supply of CRMs.

The benchmarks set for domestic capacities are at least:

10% for extraction

40% for processing

25% for recycling

Furthermore, according to the regulation, the Union’s annual consumption of each strategic raw materials at any relevant stage of processing should not exceed 65% sourced from a single third country.

Addressed challenges

Despite the potential opportunities, Europe has yet to establish an industrial practices for recovery

of Rare Earth Elements from primary ores, primarily encountering these bottlenecks:

Mature low cost technologies for effective beneficiation process, to maximise the extraction and concentration of the REEs from the gangue material to ease and reduce the cost of milling from REE recovery in the downstream hydrometallurgical processes.

Mature low cost technologies for effective beneficiation process, to maximise the extraction and concentration of the REEs from the gangue material to ease and reduce the cost of milling from REE recovery in the downstream hydrometallurgical processes. Environmentally friendly and low cost hydrometallurgical cracking process to extract the REE from the ores with circular practices at low temperatures.

Environmentally friendly and low cost hydrometallurgical cracking process to extract the REE from the ores with circular practices at low temperatures. Responsible mineral processing step to remove the radioactive elements (U and Th) complying with the local and international safety regulations and ensuring proper handling, storage management and suitable product-oriented valorisation routes.

Responsible mineral processing step to remove the radioactive elements (U and Th) complying with the local and international safety regulations and ensuring proper handling, storage management and suitable product-oriented valorisation routes. Competitive separation and purification process which has capabilities to treat variable ore types in an effective way to recover high quality Nd, Pr, Dy for permanent magnet production and securing routes for other REEs.

Competitive separation and purification process which has capabilities to treat variable ore types in an effective way to recover high quality Nd, Pr, Dy for permanent magnet production and securing routes for other REEs.